Accruals Accounting?

6.1 Accounts structure

The financial statements are a report in financial terms on the activities and resources of the charity, and must comprise:

• A Statement of Financial Activities (SOFA) for the year that shows all incoming resources made available to the PCC and all resources expended by it, and reconciles all movements in its funds. The statement should consist of a single set of accounting statements and be presented in columnar form where the PCC has restricted income or endowment funds.

• A balance sheet that shows the assets, liabilities and funds of the charity. SORP 2015 also comments that the balance sheet may be presented in columnar format. This is not mandatory but using it ensures a more detailed and therefore informative presentation of the required analysis of assets and liabilities by category of fund. The balance sheet (or the notes to the financial statements) should also explain in general terms how the funds may or, because of restrictions imposed by donors, must be utilised.

• Notes to the financial statements, explaining the accounting policies adopted and explaining or expanding upon the information contained in the accounting statements referred to above, or which provide further useful information. This will include notes analysing the figures in the primary financial statements and explaining the relationships between them.

• A cash flow statement. The largest PCCs with £500k gross income for the year must provide a cash flow statement under FRS 102. Such parishes, if exceeding £1m gross income, will require a full audit, and the PCC's auditor will advise accordingly.

The financial statements should include all the money and other assets entrusted to the PCC for whatever purpose, and show how they have been expended during the year and how the unexpended balance of each fund was held at the year end.

The corresponding figures for the previous year must be provided in the financial statements in accordance with generally accepted accounting practice, i.e. adjusted where necessary to show them on the same basis as the current year's figures.

However, under SORP (FRS 102), the corresponding figures for last year in respect of the SOFA's fund-accounting columns (and those of the balance sheet if that option is taken up) must now be shown - either on the face of the SOFA /Balance Sheet or else 'prominently' in the accounts notes. The latter option can easily be achieved for the SOFA by copying last year's SOFA into the accounts notes but omitting its comparative figures column - subject to any changes that may be needed for comparability.

6.2 The notes to the accounts and the principle of materiality

Information is material and therefore has relevance if its omission or misstatement could influence the economic decisions of users made on the basis of the financial statements. Transactions or amounts that are clearly insignificant need not be separately shown or explained in the financial statements. As a general rule, a transaction or amount may be treated as insignificant ('immaterial') if it is without doubt too trivial to influence the reader of the financial statements. Too much detail about small items may confuse the overall picture, but if there is doubt about whether or not something is 'material', the information should be included. The exception to this is related party transactions, which are by definition all material.

6.3 Accounting policies

In order to understand the figures in the financial statements, the reader needs to know the basis on which they have been prepared. The 'accounting policies' note to the financial statements should therefore disclose that the financial statements are prepared under the current Church Accounting Regulations and comply with the current Charities SORP and applicable accounting standard FRS 102.

In addition, the significant accounting policies and assumptions adopted for dealing with any material items should be briefly but clearly explained in the notes to the financial statements. They will include an explanation of the estimation techniques that have been used, where judgement is required to record the value of incoming or outgoing resources and of assets and liabilities.

The accounting policies adopted must comply with FRS 102 (in particular sections 2 and 10) and must also be consistent with the 'going concern' concept, namely that the PCC is considered to be a going concern for the foreseeable future (normally at least one year from the date of signing the Annual Report and accounts), and must provide relevant, reliable, comparable and understandable information.

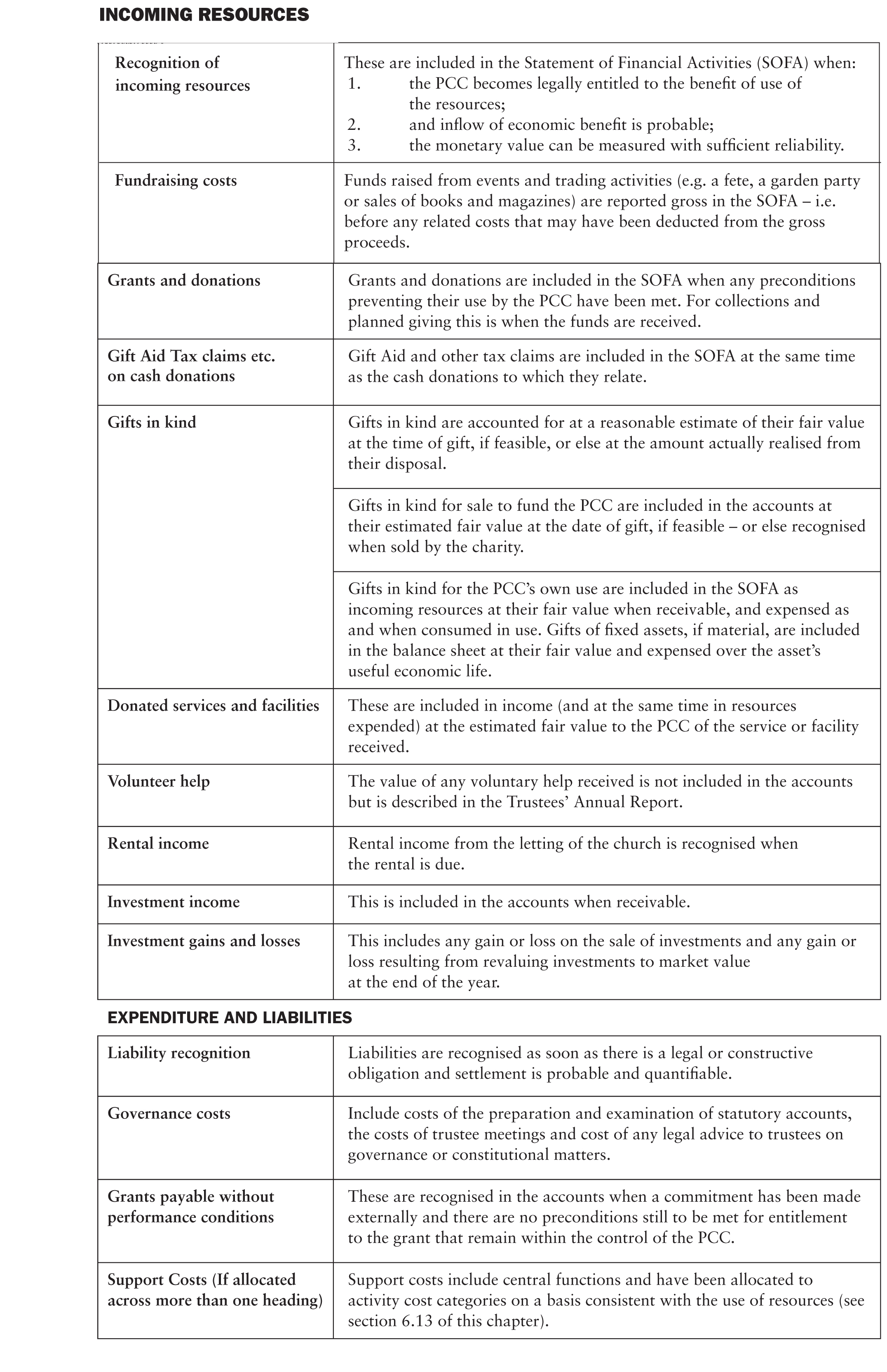

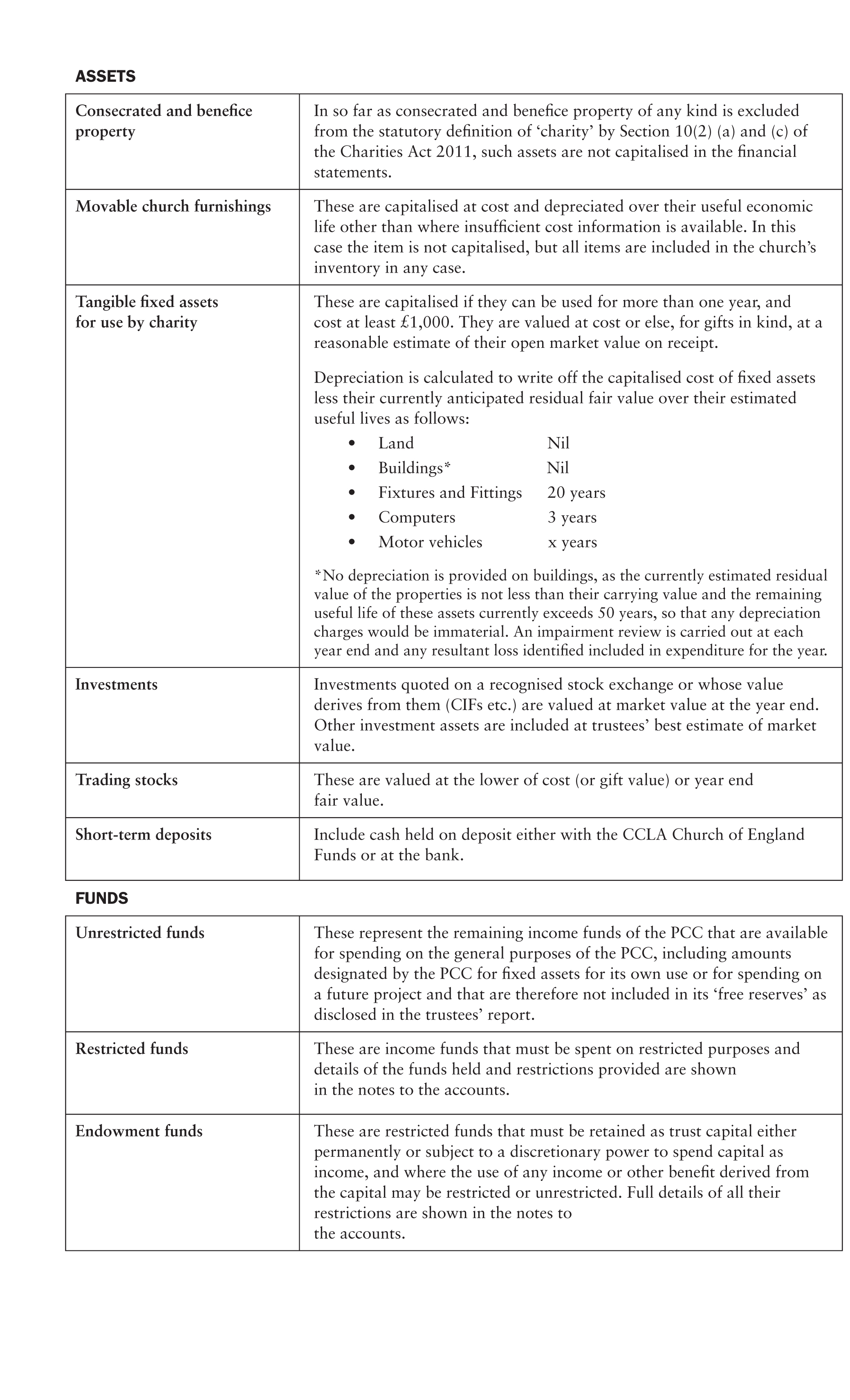

A model set of accounting policies is set out below. PCCs should add to and amend these as appropriate for their particular circumstances.

The financial statements should be approved at a meeting of the PCC and the balance sheet signed on the PCC's behalf and the date of approval shown. Only one signature is needed; this is usually that of the chairman of the meeting. However, in the case of the Church of England, where the chairman of the meeting will normally be the minister, it is good practice for the financial statements also to be signed by one other member, normally the treasurer or churchwarden, to underline the joint responsibility of both the minister and members of the PCC.

Model set of accounting policies

PCCs should adapt these as necessary. The accounting policies should be disclosed in the financial statements to assist the reader, particularly in respect of material items.

Basis of preparation

The PCC is a public benefit entity within the meaning of FRS 102. The financial statements have been prepared under the Charities Act 2011 and in accordance with the Church Accounting Regulations 2006 governing the individual accounts of PCCs, and with the Regulations' 'true and fair view' provisions, together with FRS 102 (2016) as the applicable accounting standards and the 2016 version of the Statement of Recommended Practice, Accounting and Reporting by Charities (SORP (FRS 102)).

In addition to the disclosure of accounting policies described in this chapter further disclosures not relating to the figures are required to support the information in the SOFA and balance sheet. These are detailed below.

6.4 Charitable commitments

An unfulfilled commitment to make a grant or other voluntary contribution (funding) to a third party will not normally be a legally binding obligation, but where a valid expectation was created in the mind of the other party as at 31 December, with no pre-conditions for entitlement not yet met, it should be recognised in full as a liability in the financial statements for the year.

Where a PCC has authorised expenditure out of its unrestricted funds without making any accruable commitment as above, the PCC may wish to designate unrestricted funds to represent this future expenditure commitment. Any such amounts should be shown separately as designated funds, and clearly explained in the notes to the financial statements. The notes should also explain why the PCC has set up such a fund.

Particulars of all material commitments must be disclosed in the notes, whether or not the expenditure has been charged in the financial statements. The note should show the amounts involved, when the commitments are likely to be met and the movements on commitments previously reported.

Where later events make the recognition of liability no longer appropriate, the provision should be cancelled by credit against the relevant expenditure heading in the SOFA. The credit should mirror the treatment originally used to recognise the liability and should be disclosed separately, with a clear explanation in the notes to the financial statements, if material.

Disclosure and/or provision as appropriate may need to be made similarly for any commitment the PCC may have in relation to the repair and maintenance of capitalised or non-capitalised fixed assets such as benefice or consecrated property. If these amount to legal or constructive obligations, they will have to be accounted for as liabilities and charged to the SOFA. However, if there is no accruable liability contractual commitment at the balance sheet date, any funds set aside for repair and maintenance should be regarded as designated funds and not charged to the SOFA but instead should be disclosed as above as either contingent liabilities or cyclical maintenance commitments. The Annual Report should in any case say when the last quinquennial inspection was held and give details of the immediate works needed or needing completion.

6.5 Other commitments

Particulars of all other material binding commitments should also be disclosed. This may include, for example, operating leases for equipment or premises used by the church. Under FRS 102, the disclosure required here, for lessors and lessees alike, is the amount of the minimum payment commitment under operating leases up to the earliest break clause therein.

6.6 Loan liabilities secured on the PCC's assets

If any specific assets (whether land or other property) of the PCC are subject to a mortgage or charge, given as security for a loan or other liability, a note to the financial statements must disclose (a) particulars of those and (b) their carrying value.

6.7 Contingent liabilities

A contingency existing at the year end which is 'probable', i.e. considered likely to crystallise into a material liability, ceases to be 'contingent' for accounting purposes and should instead be accrued in the financial statements. The same applies to a previously unquantifiable present obligation that can now be quantified. The amount of the liability to be accrued must be capable of being reliably estimated with reasonable accuracy at the date on which the financial statements are approved.

The notes must disclose the nature of each contingency unless its possibility is 'remote', the uncertainties that are expected to affect the outcome and an estimate of the financial effect where practicable. The SORP says: 'in extremely rare cases where FRS 102 allows non-disclosure of information that would be expected to seriously prejudice the position of the [PCC] in a dispute with other parties, the general nature of the dispute and the reason why disclosure has note been made must be given'.

If such an estimate cannot be made, the financial statements should show why it is not practicable to make such an estimate.

6.8 Grants payable

If a PCC makes grants to institutions that are material in the context of its grant making, the PCC should disclose details of a sufficient number of these grants to provide an understanding of what the PCC has supported. The information given should include not only the purpose (or class of purpose), but also (subject to the exceptions, mentioned below), the name of the institution and total value of grants given.

The Trustees' Annual Report should include the PCC's policy for making grants and show the nature of the institution receiving them.

There is no requirement to disclose any grants if they are not material in relation to the PCC's total expenditure, but PCCs will usually wish to disclose all their major contributions to other charitable bodies, whatever their value, and this is to be encouraged. These can be shown in the Annual Report or in the notes to the financial statements or alternatively on the PCC's website if a link is provided in the accounts notes. Very exceptionally the disclosure of details of grants made to institutions could seriously prejudice the purposes of either the PCC or the recipient. The SORP's module 16.22-24 paragraphs explain what to do in these circumstances, by saying so in the notes and by disclosing their total number, value and general nature and that an exemption applies. The previous version of the SORP also required giving the sensitive information to the Charity Commission on a confidential basis - but this is not mentioned in the new SORP.

An unconditional or 'blanket' exception in s.132 of the Act provides that no disclosure need be made of the amount or the name of the recipient of any individual grant made out of a trust fund during the lifetime of its founder or spouse or civil partner. The only disclosures then required in the accounts notes are of the total amount of all such grants made in the year out of that trust fund and of their purpose(s).

6.9 Transactions with members of the PCC and other 'related parties'

Where a PCC enters into any material transaction, contract or other arrangement (including a grant or donation) with any 'related party', the amounts involved and the terms and conditions should be disclosed in the notes to the financial statements. Certain transactions need not be disclosed.

These include donations of any money or in kind from PCC members or those closely connected with them or any other 'related party' of the PCC (as long as any terms of trust imposed cannot be seen as altering materially the way the PCC operates), benefice property maintenance and employee contracts. These are unlikely to influence the separate independent interests of the charity. The total remuneration of employees is disclosed separately.

Any decision by the PCC to enter into a transaction should be, and should be seen to be, influenced only by the consideration of the PCC's own interests as a charity. This is reinforced by charity law rules which, in certain circumstances, can invalidate transactions where the PCC has a conflict of interest. Therefore, all transactions with related parties (including especially PCC members, their close family members and any legal entities under their control or significant influence) are to be disclosed. Transparency is particularly important where the relationship between the PCC and the related party suggests that the transaction could possibly have been influenced by interests other than the PCC's. It is possible, subject to charity law constraints, that the reported financial position and results may have been unlawfully affected by such transactions and to show that this has not happened information about these transactions and their propriety is therefore necessary for readers of the PCC's financial statements.

Transactions with PCC members personally or persons with a close family or business connection with them or with any other related party of the PCC are always regarded as material under SORP (FRS 102) and the amounts involved must therefore be disclosed, together with the following details required by the SORP:

• the … relationship* [with the PCC and] the interest of the related party … in the transaction;

• a description of the transaction(s);

• [any] outstanding balances … at the [year end] and any provisions for doubtful debts;

• any amounts written off from such balances during the [year];

• the terms and conditions, including any security and the nature of the consideration to be provided in settlement;

• details of any guarantees given or received;

• any other elements of the transactions which are necessary for the understanding of the accounts.

(*related parties other than PCC members and their close family/business connections - see below - can be grouped together for an aggregate disclosure by type of transaction, e.g. for group members)

The name of the PCC member (if any) involved must be separately disclosed in the notes. Any 'private benefit' to a PCC member or close family/business connection must be separately disclosed together with the legal authority for such benefit. This includes details of the total salary costs where a PCC member is also a PCC employee. In such cases, the SORP requires disclosure of:

• the legal authority under which the payment was made …;

• the name of the remunerated trustee;

• details of why the remuneration or other employment benefits were paid;

• the amount of remuneration paid;

• the amount of any pension contributions paid by the charity for the [year];

• the amount of any other benefit, for example any termination benefits, private health cover or the provision of a vehicle.

Where the PCC members have received no such remuneration or other taxable benefits, this fact must be stated.

Where travelling, subsistence or any other out-of-pocket expenses have been reimbursed to a member of the PCC or paid to a third party on a member's behalf, the aggregate amount of all such trustee-expenses must be disclosed in a note to the financial statements. The note must also indicate the nature of these personal expenses (e.g. travel, subsistence, entertainment etc.) and for how many of the PCC's members.

Where the PCC members have received no such reimbursement, this fact should be stated.

Sometimes PCC members act as agents for the PCC and make approved purchases on its behalf and are reimbursed for this expenditure, e.g. payment for stationery or candles. Such reimbursed expenditure is not personal to the trustee concerned, nor does it count as goods or services provided by a PCC member personally, and as it is not a personal expense there is no need to disclose it. Likewise, although no longer mentioned in the SORP, there is no need to disclose routine expenditure that is attributable collectively to the services provided by the PCC, such as providing reasonable refreshment for everyone at a PCC meeting.

Please note that in respect of related-party transactions all are now regarded as material. A transaction involving a PCC member or other related party must always be regarded as material regardless of its size. For this purpose, the SORP's glossary widens its definition of a 'related party' of the reporting charity by including a donor of land at any time, but no longer includes (i) a seconded employee's employer if not already a related party and likewise (ii) any non-charitable trust from which a trustee could benefit. FRS 102 requires disclosure of the total of all donations made to the PCC by related parties, trustees included. That would include any trustee-expense claims waived, this being just another class of gift in kind, unless immaterial, regardless of whether any individual related-party transactions have to be disclosed.

6.10 Staff costs and employee benefits

The total staff costs showing the split between gross wages and salaries, social security costs and pension costs, must be disclosed in the notes to the financial statements. (Clergy paid through the diocese are not PCC employees.)

The pension costs must be split between the employer costs of Defined Contribution schemes and the operating costs (other than finance costs) of Defined Benefit schemes and the total cost of any other forms of employee benefit must be shown separately, as must also the total of any staff redundancy or termination costs for the year.

Any costs of staff whose employment contracts are with a related party must be included.

All PCCs must disclose the average number of employees for the year. The employee numbers must be the average headcount, but full-time equivalents can be shown as well, as can staff deployment by activity type. Regardless of charity size or classification of expenditure in the SOFA, the numbers of employees of the PCC with 'total emoluments (excluding employer pension costs)' in each £10k bracket from £60k upwards must also be disclosed or else the fact there were none must be stated.

All PCCs must disclose the total cost of any 'employee benefits' received by trustees and 'key management personnel' for their services to the PCC. This is not optional for 'smaller' PCCs. Consideration needs to be given to identifying the 'key management personnel' who are required to report back directly or indirectly to the trustees in respect of any delegated decision-making powers, e.g. on the day-to-day management of the PCC.

6.11 Auditor's or independent examiner's remuneration

The notes to the financial statements should disclose separately the amount payable to the auditor or independent examiner in respect of:

• audit or independent examination services;

• other assurance services (if any) and other financial services such as taxation advice, consultancy, financial advice and accountancy, disclosing the fees separately under each head.

6.12 Ex gratia payments

The total amount or value of any:

• payment made;

• non-monetary benefit given;

• other expenditure of any kind;

• waiver of rights to property to which a PCC is entitled

which is made not as an application of funds or property for the general purposes of the PCC but in fulfilment of a compelling moral obligation, e.g. voluntarily surrendering part of a legacy if the reasonable needs of the testator's close family were not adequately provided for, should be disclosed in the notes to the financial statements, together with the 'legal authority or reason for making it'. It should be noted that special authorisation is needed for any proposed 'ex gratia payment' and that it requires prior application to the Charity Commission, but that this does not normally include staff benefits of any kind.

6.13 Support costs

For the vast majority of PCCs, support costs will be for church running expenses and there will be no need to allocate them across different expenditure categories. For larger PCCs, however, support costs must be allocated to the relevant activity cost categories they support, as identified in the Trustees' Annual Report for performance reporting against the objectives set for the year.

Support costs now include governance costs (which are no longer disclosable on the face of the SOFA) and are costs incurred in the course of undertaking an activity that, while necessary, does not itself produce or constitute the output of the charitable activity. Similarly, costs will be incurred in supporting income-generating activities such as fundraising. They include generic costs such as payroll administration, accounting costs and computer maintenance as well as charity governance costs. Since they do not constitute an activity but instead enable activities to be undertaken, they are allocated to the relevant activity cost category they support according to the following principles:

• Where appropriate expenditure should be allocated directly to an activity cost category

• Items of expenditure that contribute directly to more than one activity cost category should be apportioned on a reasonable, justifiable and consistent basis, e.g. the cost of a staff member whose time is divided between a fundraising activity and a charitable activity should be apportioned on the basis of time spent on the particular activities.

There are a number of bases for apportionment that may be applied. Examples include:

• usage, e.g. electricity costs for the church and the hall

• per capita

• floor area

• time.

There should be a note to the financial statements that provides details of the total support costs incurred. If there are material items or categories of expenditure within this total, these should be separately identified. It is recommended that a grid is used that lists the activities and the separately identifiable material support costs that have been allocated.