The Stewardship Report, entitled “Investing for a just and sustainable world,” outlines the Pensions Board’s approach to responsible investment and highlights the significant progress made on key stewardship objectives as well as priorities for 2022. The report, submitted to the Financial Reporting Council (FRC), details new investor engagement with the social housing sector, in response to the Archbishop’s commissioned Coming Home report, as well as becoming a founding signatory of the Asset Owner Diversity Charter. The Board also updates on its leadership of major international collaborations on climate change and extractive industries and the engagement with the mining sector following the destruction of the 46,000 year old heritage site in Juukan Gorge, Australia.

Clive Mather, Chair of the Pensions Board, reflected on the past year and said:

“Despite the ongoing challenges of the global pandemic, in 2021 we achieved excellent investment returns, built on a foundation of responsible investment for a just and sustainable world.”

Delivering on Net Zero:

The report reveals that the Board is ten years ahead of where it needs to be in meeting its 2050 net zero target. This is a result of significantly reducing or excluding companies that are not aligning to the transition. As a consequence, holdings in oil and gas companies was reduced to 0.28% of the fund. The most significant contribution to the progress to date has been the creation of the FTSE TPI Climate Transition Index in which the Board invests its passive portfolio, and application of the same rationale within the Board’s active investments. The Pensions Board announced its first investment in the index in 2019.

Change in engagement focus:

In 2021 the Board played an instrumental role in setting up and chairing the investor process to establish the first Net Zero Standard for the oil and gas sector as well as co-leading engagement for the global engagement initiative Climate Action 100+ with Shell. In 2022 the Board is shifting its focus to industry sectors that demand energy from oil and gas companies. This will see the Board step down from leading engagement with Shell and begin co-leading engagement with Europe’s largest car manufacturers, BMW, Mercedes-Benz, Renault, and Volkswagen. The Board has already filed shareholder resolutions at VW and are currently challenging the company on its approach to corporate climate lobbying. The Board will continue to lead engagement on corporate climate lobbying as well as new engagement of the steel and mining sectors. The shift in climate engagement focus reflects a change the Board believes will be essential in the second phase of Climate Action 100+.

Adam Matthews, Chief Responsible Investment Officer, said:

“As an investor in most sectors of the global economy, we take a universal view of our ownership of assets which means driving systemic change in the real economy that can impact whole sectors. We are willing to take a lead and establish global collaborations of investors to see the creation of global standards where they do not exist and drive alignment to those standards where they do exist.”

“If the demand for energy doesn’t change, those companies that are supplying it won’t change. We have developed an exacting global net zero standard for the oil and gas sector, which companies that wish to retain their social license can implement. Ultimately those same companies’ ability to deliver on their targets will largely be shaped by a change in demand for oil and gas from sectors like autos, aviation and shipping. If you change demand you change supply and that is why as a fund we will be refocusing our engagement efforts on those demand sectors.”

Looking Ahead:

- The report covers stewardship activities prior to the invasion by Russia of Ukraine so it does not capture the extensive steps the Board have taken on this subject which will be captured in its 2022 report. Other major priorities for 2022 include:

- Co-leading with BT Pension Fund and investor networks the development of the first public framework to assess government bonds on climate criteria through the ASCOR Project. The Board will also consider how it and other pension funds can invest in support of the transition in emerging economies.

- Working in partnership with the United Nations to establish the first independent Global Tailings Institute to support implementation of the Global Industry Standard on tailings management.

- Launching Mining 2030 Investor Initiative to develop an agenda to address eight systemic challenges to the mining sector and the role it plays in society and the low carbon transition.

- Launching a Global Standard on Corporate Climate Lobbying and a collaborative investor initiative to ensure alignment by companies to the new standard.

- Advocating for a major re-focus through CA100+ to address both demand and supply sides of the energy transition.

- Chairing the Global Paris Aligned Investor Initiative (with Dutch fund APG) to oversee further evolution of the Net Zero Investment Framework that pension funds are using to make and deliver on net zero targets

Further information

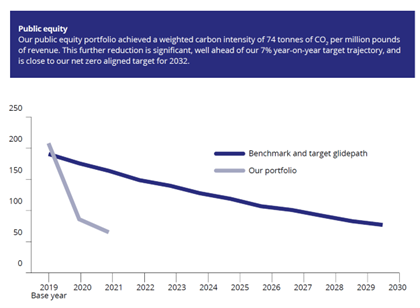

- The Pension Board uses the Net Zero Investment Framework and has adopted an ongoing target of a 7% year on year reduction in weighted average carbon intensity (WACI), beginning with the benchmark’s 2019 WACI. The reductions in portfolio WACI achieved in 2020 and 2021 mean that the Pensions Board is 10 years ahead of the 7% year on year target.

- Climate Action 100+ (CA100+) is an investor-led initiative to ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change. Investors work through CA100+ to engage with company executives and board members to align with certain Paris-based principles. The engagement leads periodically change.

- The Following graphic details the progress made against the Board’s net zero target for public equity investments: