Receipts and Payments Accounting

4.1 What is Receipts and Payments account?

As the name suggests, it is a way of summarising all receipts (the cash coming into the parish, such as Sunday giving, special collections, other gifts of money etc.) and all payments (the cash going out of the parish, such as electricity, parish share, giving to other good causes etc.). To give a full picture, it also needs to list the assets (owned by the PCC) and liabilities (owed by the PCC) at the year end.

All Church of England parishes must have a financial year that is the calendar year: 1 January to 31 December (see the Church Representation Rules).

The annual report and accounts has four components that you need to provide at the end of the year.

1. Trustees' Annual Report

2. A Receipts and Payments account (for each fund)

3. A Statement of Assets and Liabilities

4. Independent examiner's report on the accounts

To see how these reports work in practice we have provided an example for a fictitious church - St Emillion's.

The Charity Commission sets the ground rules for the design and content of the Trustees' Annual Report and the independent examiner's report. There is no design that you 'must' follow for the Receipts and Payments account and the Statement of Assets and Liabilities. You must give at least the minimum information required by law and the wider church. Obviously, it is best to present this in a consistent way from year to year. The example shown in this book gives a recommended design for the trustees' report and annual accounts.

This guidance aims to make annual reporting easier. By producing the recommended reports and accounts you will also have provided all the information required by law.

4.2 What do PCCs have to do to produce their annual report and accounts?

Summarise:

• What went into the bank, for what fund (purpose) and where it came from (receipts).

• What came out of the bank, from what fund and what was it spent on (payments).

• The year end bank balance(s) on all the funds of the PCC and particulars of any investments and other non-monetary assets as at the end of the year (even if sold since) and to what fund they belong.

• Details of any amounts owing to the PCC (e.g. Gift Aid and GASDS claims) and of any loans, unpaid bills or other liabilities of the PCC as at the end of the year (even if paid since) and to what fund they relate.

To do this:

Consider how money is received and spent by the PCC and then decide on the most sensible account headings to use in order to complete the annual Return of Parish Finance. The return has two main sections: incoming resources and resources expended and these are divided into categories and account headings to give more detail.

Some basic practical and consistent account headings have been identified for the PCC to adopt or use as a checklist. They relate to parish life and link easily to the Receipts and Payment reports and the annual Return of Parish Finance report.

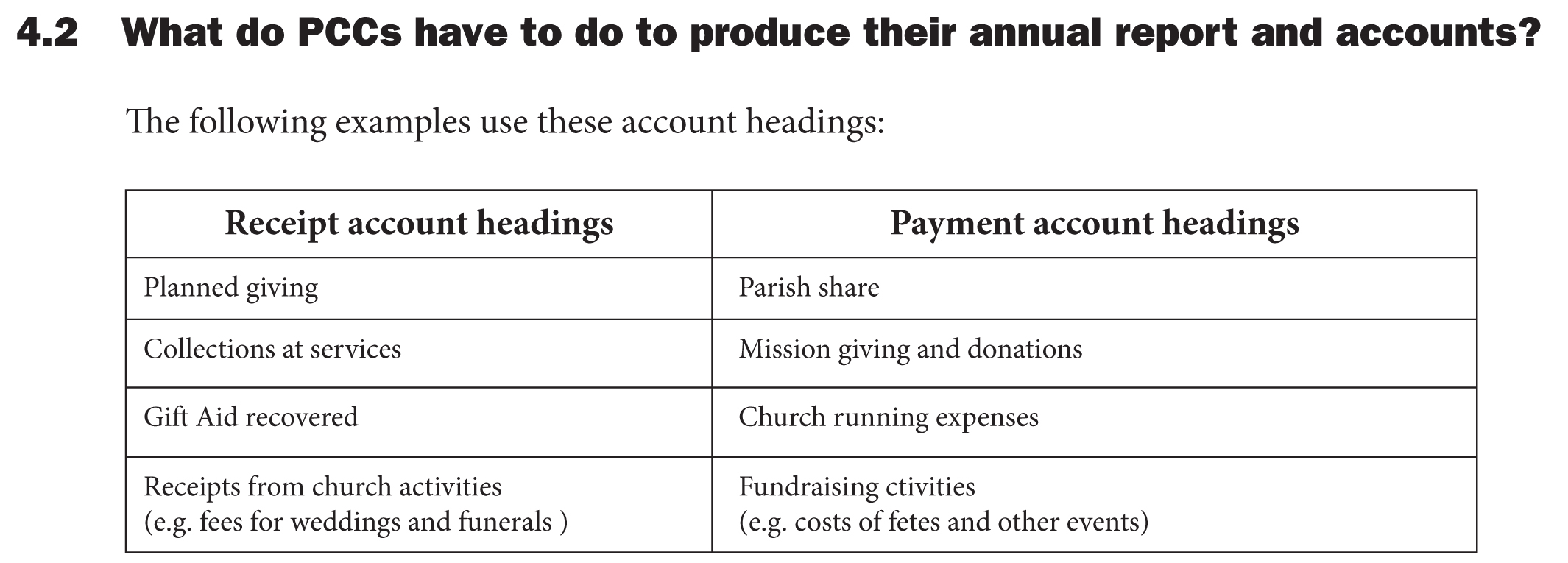

The following examples use these account headings:

Example individual account descriptions are given in Chapter 2. The individual account descriptions included in each heading can be as detailed as the PCC wishes. Each time you get or spend money you also need to record the fund that you used. If you use a cashbook or spreadsheets you simply add extra columns for the funds. Church specific software will manage this for you.

Using the limited number of categories and account headings enables your accounts to be compared with other parishes. Doing this gives an overall picture of how parishes within each diocese or across the country are getting and spending their money.

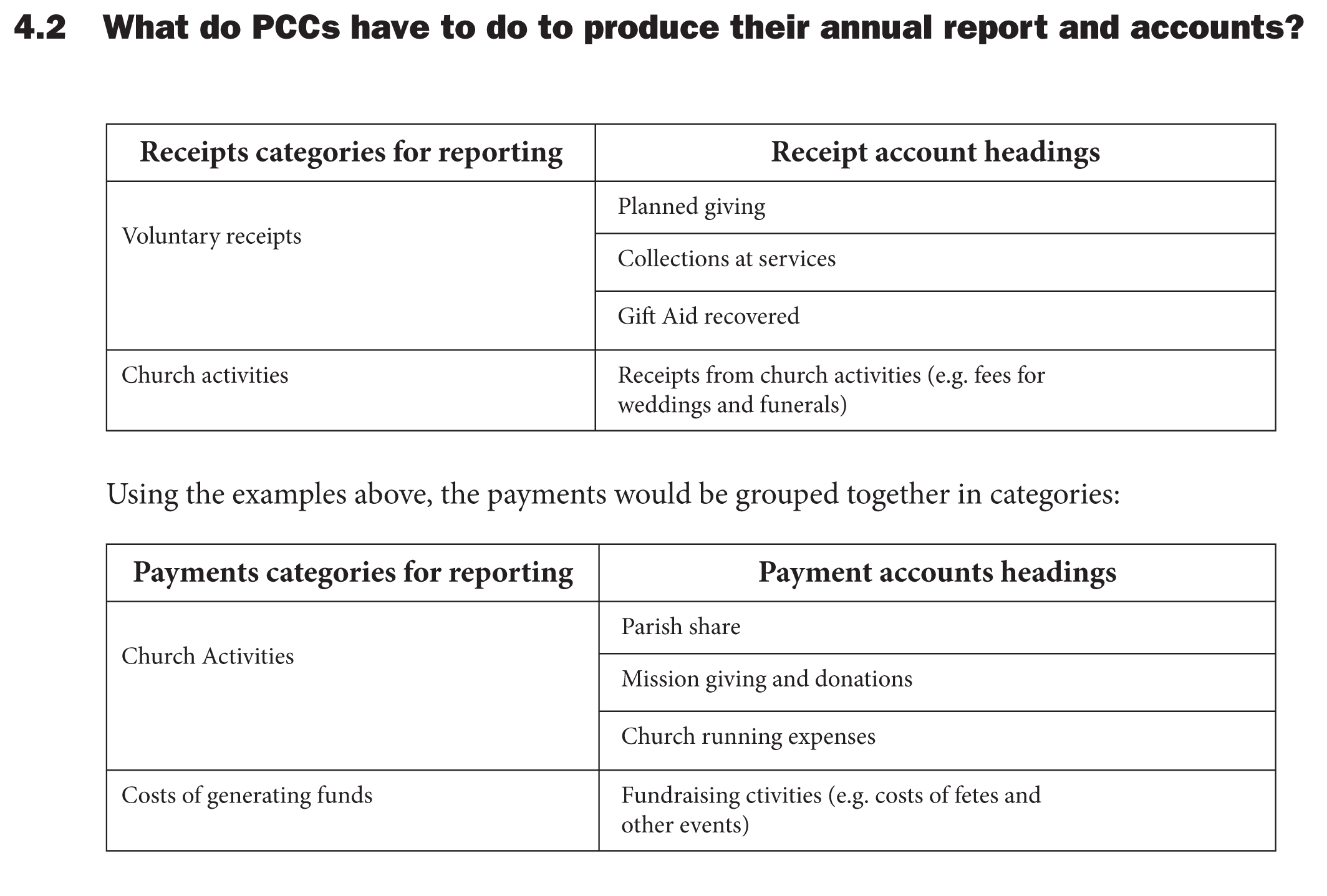

The category groupings bring together similar account headings. For example, all donations are shown as voluntary receipts and the running costs of the church are shown as church activities. The headings given here are suggested for parish use, and are in line with guidance from the Charity Commission and the Return of Parish Finance.

There are two main sections to the accounts: 'Receipts' and 'Payments'. These are divided into categories and account headings to give more detail. Using the examples above, the receipts would be grouped together in categories:

Once the account headings have been decided and the funds that the money belongs to have been identified, receipts and payments can be recorded.

4.3 Practical hints and tips

1. The PCC must record full particulars of any significant gifts in kind in the accounting records, so that those that the PCC still owns at the year end can be listed as 'non-monetary' assets in the Statement of Assets and Liabilities. Depreciation does not need to be recorded, as it doesn't feature in Receipts and Payments accounting.

2. Recording money the PCC receives or pays that covers more than one account

For example, the PCC may be given money or make payments that cover more than one account heading, such as purchasing Bibles partly for the bookstall and partly as a gift in kind to a missionary society.

The PCC needs to divide the money between the different activity account headings - it is called apportionment and should be done on a 'reasonable basis'. This means that if 20% of the Bibles were for the bookstall and 80% for the mission, then 20% of the cost would be shown as bookstall costs and 80% as mission grants.

3. Recording money the PCC receives or pays that covers more than one fund:

The PCC may receive or pay out money that relates to more than one fund. For example, building work that is partly normal maintenance out of the general fund and partly improvement. The latter may have to come out of a restricted fund for the building. In such a situation, it should be split on a reasonable basis, e.g. if the building work done is 50% normal maintenance and 50% improvement, then the payment will be split half to the general fund and half to the restricted fund.

4. Netting off is not allowed:

The PCC must record all receipts and payments gross, so for example if the PCC has a fete which costs £100 for materials/publicity and it raises £500 from the fete, then the accounts must not show the receipts less the payments which would be an overall receipt of £400. In this case the PCC must show:

i. Receipts = £500

ii. Payments = £100

Where money simply passes through the PCC's bank account, but the funds do not belong to the PCC, then the receipt and the payment should not be included in the PCC's annual Receipts and Payments account. This is because the PCC was only the agent or conduit for the money recorded.

4.4 Trustees' Annual Report (TAR)

This report gives the PCC the chance to tell everyone the aims of the church and what the PCC is doing to make them happen. The PCC can share 'good news' stories and how people's giving made them possible.

Trustees are collectively responsible for this report, and the drafting should not just be left to the treasurer. Its aim is to give a clear and concise description of the mission and ministry of the church. Also remember that this report is meant for anyone, so that they understand why and how the church works.

The preparation of the Trustees' Annual Report is covered in Chapter 3. An example of the Trustees' Annual Report is shown in Chapter 5.

4.5 Receipts and Payments account

The first financial report shows how the parish's cash was received and spent and how this related to your funds. You can produce a receipt and payment summary for:

a. each fund - summarising all of the cash going in to or out of each fund separately;

b. each type of fund - summarising all of the cash going in to or out of each fund type separately;

c. all three types of fund combined in a single statement with each type in a separate column.

The recommended option is option C. However, certain information is needed to complete the receipts and payments summary. The following table shows you the questions you need to answer and where the information is put on the report.

The St Emillion's report and accounts demonstrates how this works in practice:

4.6 Statement of Assets and Liabilities

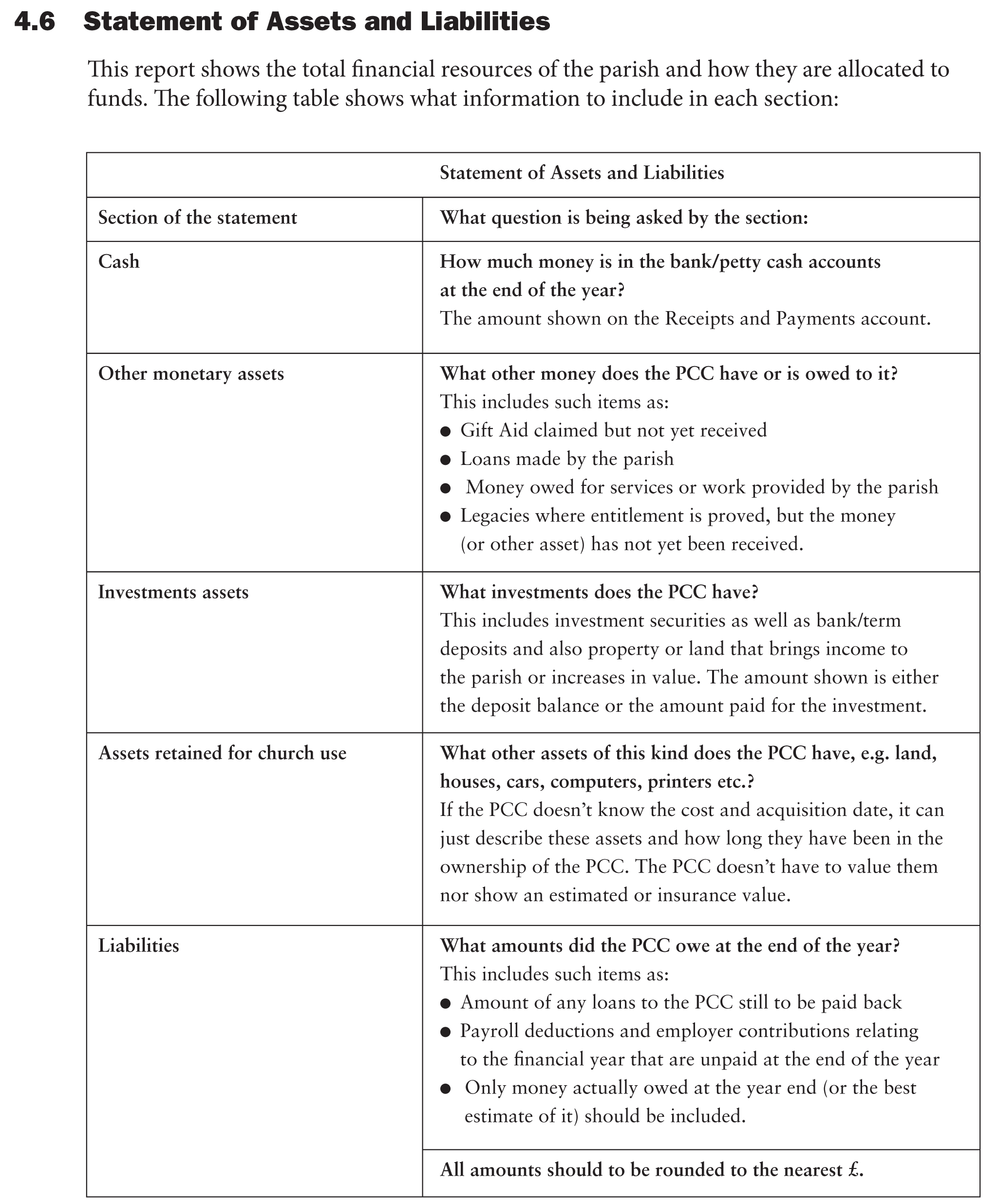

This report shows the total financial resources of the parish and how they are allocated to funds. The following table shows what information to include in each section:

When deciding what needs to be shown as an asset or liability, the PCC needs to ask itself: Is it vital information? This means that if the PCC left that information out, would it make the financial position harder to understand?

For example, at the end of the year the PCC owed a builder £5 for wood - this amount will not make a big difference to the church so need not be shown. The independent examiner can give advice if the PCC is not sure.

Although the PCC is putting a lot of information into these accounts there are often things that it wants to explain or add. For example, it may need to explain what its funds are given for or any transfers between funds that were made. Or where it doesn't know the end of year open market value of an asset that isn't a sum of money (e.g. a lease on a building; stocks and shares; a bequest of such assets) it can just give identifying information about the asset, its condition and use, also its cost (if purchased). The PCC can do all this by adding 'notes' to the accounts.

Notes to the accounts may help the reader to understand the accounts better. For example, the PCC might choose to include further details about payments and receipts, e.g. a breakdown of church running costs. There is a balance to be struck between providing useful additional information to the reader, and providing so much detail that it can confuse rather than help. These notes can be written as part of the Statement of Assets and Liabilities or else within the Trustees' Annual Report. This is illustrated in the St Emillion's reports.

4.7 Independent examiner's report

Who checks the PCC's accounts?

The PCC needs to show that its accounts comply with the Charities Act.

At the end of the year the PCC must have the accounts checked by an independent person who is not on the PCC (or any PCC sub-committee) and who understands charity accounting (this applies to all PCCs under Church regulations). The independent examiner will need to examine the accounts and underlying records within the context of the annual report, and provide the PCC with a statutory form of report on the accounts.

Chapter 1 provides guidance on recruiting an independent examiner, and working with them.

4.8 What happens next?

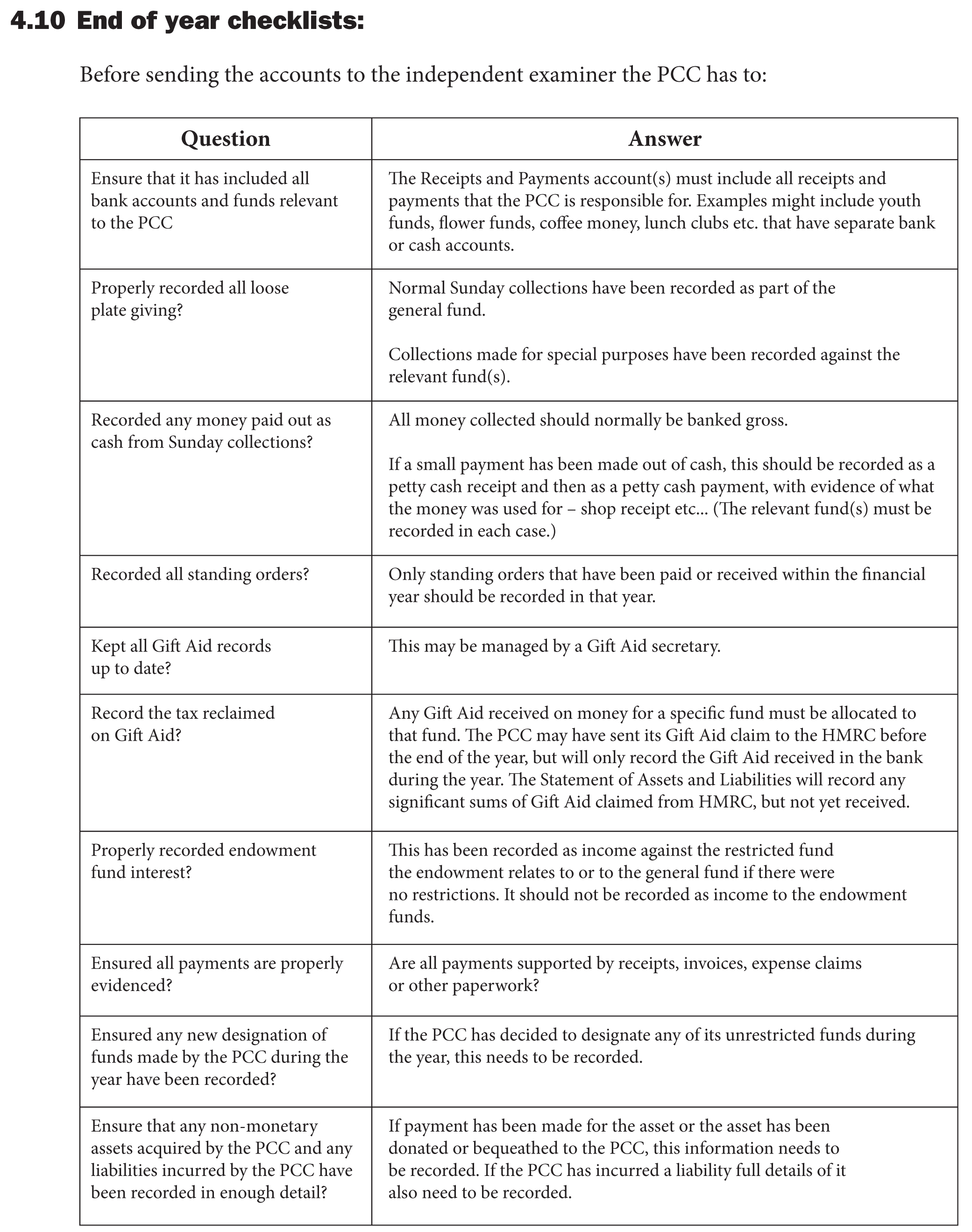

The PCC then needs to approve the Trustees' Annual Report, with the accounts and Independent Examiner's Report attached. Note, the accounts are the responsibility of the whole PCC and not just the treasurer. Then the Report and Accounts are ready for a wider audience.

4.9 Who does the PCC give the report and accounts to?

The accounts are published - put on notice boards within the church at least seven days before the Annual Parochial Church Meeting. The PCC treasurer will normally be required to explain the accounts to the meeting. Copies of these reports are sent to the Diocesan Office with the Parish Return of Finance report.

The accounts are public documents, so every member of the public has a right to see them and can request a copy.

If the PCC has registered as a charity with the Charity Commission it must file a copy of its report and accounts and completed annual return. (This involves uploading a pdf of the report and accounts completing the online report.)